The Main Principles Of Estate Planning Attorney

Table of ContentsHow Estate Planning Attorney can Save You Time, Stress, and Money.Getting My Estate Planning Attorney To WorkNot known Incorrect Statements About Estate Planning Attorney Our Estate Planning Attorney PDFsEstate Planning Attorney Can Be Fun For AnyoneEstate Planning Attorney Fundamentals ExplainedSee This Report on Estate Planning Attorney

We additionally established up depends on That you can avoid Massachusetts probate and shelter your estate from estate tax obligations whenever feasible. We can also make certain that liked ones who are unable to live separately are attended to with a special requirements count on. At Facility for Elder Regulation & Estate Planning, we understand that it can be hard to think and speak about what will certainly occur after you pass away.We can help (Estate Planning Attorney). Call and establish up a free appointment.

They help you develop an extensive estate plan that lines up with your wishes and objectives. Estate intending lawyers can aid you stay clear of blunders that can revoke your estate strategy or lead to unplanned consequences.

Estate Planning Attorney Can Be Fun For Everyone

Employing an estate planning attorney can help you avoid probate altogether, conserving time, and money. An estate preparation attorney can aid secure your assets from legal actions, lenders, and other claims.

Cloud, Minnesota, connect to today. To read more regarding personal bankruptcy,. To learn more about realty,. To discover about wills and estate preparation,. To call us, or call us at.

The age of bulk in a provided state is established by state legislations; usually, the age is 18 or 21. Some assets can be distributed by the organization, such as a financial institution or brokerage company, that holds them, as long as the proprietor has provided the proper instructions to the banks and has named the beneficiaries that will receive those assets.

See This Report about Estate Planning Attorney

If a recipient is called in a transfer on death (TOD) account at a broker agent firm, or payable on fatality (SHEATH) account at a bank or debt union, the account can normally pass straight to the recipient without going through probate, and thus bypass a will. In some states, a comparable beneficiary designation can be included in property, allowing that possession to also bypass the probate procedure.

When it comes to estate preparation, a skilled estate lawyer can be an indispensable asset. Estate Planning Attorney. Dealing with an estate planning attorney can give various advantages that are not available when attempting to complete the process alone. From giving competence in legal matters to assisting produce a thorough prepare for your family members's future, there are several advantages of collaborating with an estate preparation lawyer

Estate attorneys have comprehensive experience in recognizing the nuances of various lawful documents such as wills, trusts, and tax laws which allow them to supply sound recommendations on just how finest to protect your properties and ensure they are passed down according to your desires. An estate lawyer will likewise be able to give guidance on just how best to browse complex estate regulations in order to make sure that your desires are recognized and your estate is taken care of appropriately.

Unknown Facts About Estate Planning Attorney

They can usually provide recommendations on exactly how best to upgrade or develop brand-new documents when needed. This may include advising modifications in order to take advantage of brand-new tax obligation advantages, or merely ensuring that all appropriate documents show one of the most present recipients. These lawyers can likewise provide continuous updates connected to the administration of trust funds and various other estate-related issues.

The goal is constantly to ensure that all paperwork continues to be legally precise and shows your present desires properly. A significant benefit of working with an estate planning attorney is the very useful assistance they provide when it pertains to avoiding probate. Probate is the legal procedure throughout which a court establishes the credibility of a deceased individual's will certainly and manages the circulation of their assets according to the terms of that will.

A seasoned estate lawyer can aid to make sure that all needed files are in area which any kind of properties are properly dispersed according to the regards to a will, staying clear of probate completely. Ultimately, working with an experienced estate planning attorney is Go Here one of the most effective ways to guarantee your desires for your household's future are carried out accordingly.

They supply vital lawful assistance to make sure that the most effective passions of any kind of small children or adults with impairments are completely shielded special info (Estate Planning Attorney). In such cases, an estate lawyer will certainly aid recognize suitable guardians or conservators and guarantee that they are given the authority necessary to take care of the properties and events of their fees

Not known Details About Estate Planning Attorney

Such trusts typically contain provisions which secure benefits gotten through government programs while permitting trustees to preserve minimal control over exactly how properties are managed in order to optimize benefits for those involved. Estate attorneys understand just how these trust funds job and can supply invaluable help establishing them up correctly and making certain that they continue to be legally compliant with time.

An estate planning lawyer can help a moms and dad consist of stipulations in their will for the care and management of their minor youngsters's assets. Lauren Dowley is a knowledgeable estate preparation lawyer who can help you develop a strategy that fulfills your details needs. She will certainly deal with you to understand your assets and exactly how you want them to be dispersed.

Don't wait to start estate preparation! It's one of the most important things you can do for on your own and your enjoyed ones.

Estate Planning Attorney - Questions

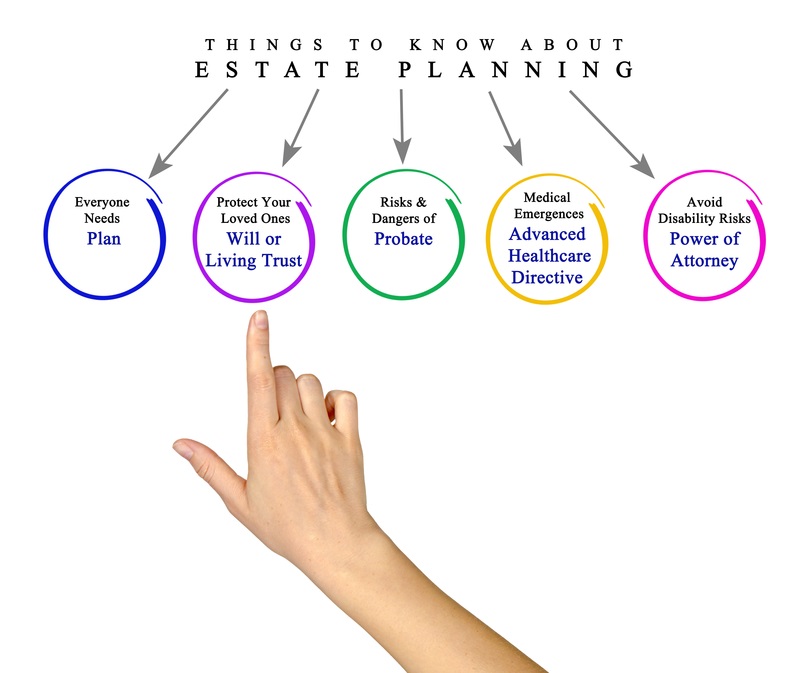

Producing or updating existing estate planning documents, including wills, trusts, health and wellness care directives, powers of attorney, and related devices, is just one of one of the most vital points you can do to ensure your wishes will certainly be honored when you die, or if you become not able to manage your affairs. In today's electronic age, there is no lack of do-it-yourself options for estate preparation.

Doing so might result in your estate plan not doing what you desire it to do. Wills, trust funds, and various other estate intending papers ought to not be something you prepare as soon as and never ever take another look at.

Probate and depend on laws are state-specific, and they do transform from time-to-time. Dealing with an attorney can give you assurance understanding that your plan the original source fits within the criteria of state legislation. Among the largest risks of taking a do-it-yourself strategy to estate planning is the threat that your papers won't truly achieve your objectives.

Examine This Report about Estate Planning Attorney

They will consider numerous scenarios with you to draft files that precisely show your dreams. One common mistaken belief is that your will certainly or trust fund automatically covers all of your assets. The reality is that certain types of residential or commercial property ownership and recipient designations on possessions, such as pension and life insurance policy, pass independently of your will or trust unless you take steps to make them work with each other.